SecureOne Compliance Program

Your compliance from us covers: Plan Documents and Amendments, Summary Plan Descriptions, Summary of Benefits & Coverages (SBC), Definitions of Terms of SBC, Privacy Notices, COBRA, PICORI Fee, Transitional Reinsurance Fee, Updated Newsletters, DOL Audits and a Compliance Reporting & Filing Department.

Compliance Department

SecureOne and Health Decisions offer a Compliance Program that interlinks our systems and your payroll vendor to fully service and populate all reporting 6055/6056, Transitional Reinsurance and PICORI Fees to the IRS.

Our complete compliance strategy reviews and monitors minimum values, Affordability testing, Cadillac tax, trigger events, proper communications to employees, look back periods, exchange notices, enrollment notices with history, …… and the many more requirements you must do for the Affordable Care Act.

Reporting

Today entities that provide minimum essential coverage during a calendar year must provide specific information to the IRS. In audits, large employers are required to report to the IRS all full-time employees where they offer these full-time employees, and their dependents, the opportunity to enroll in “minimum essential coverage”.

ACA has two categories for Employer size

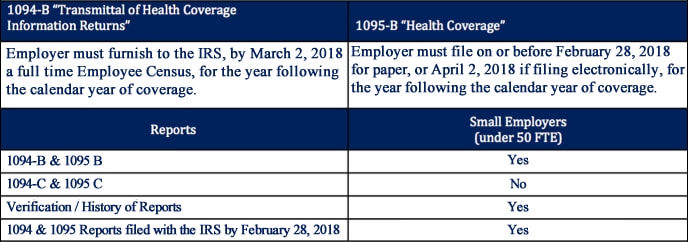

Reporting Requirement - For 2017 Year to be filed in 2018

Your compliance from us covers: Plan Documents and Amendments, Summary Plan Descriptions, Summary of Benefits & Coverages (SBC), Definitions of Terms of SBC, Privacy Notices, COBRA, PICORI Fee, Transitional Reinsurance Fee, Updated Newsletters, DOL Audits and a Compliance Reporting & Filing Department.

Compliance Department

SecureOne and Health Decisions offer a Compliance Program that interlinks our systems and your payroll vendor to fully service and populate all reporting 6055/6056, Transitional Reinsurance and PICORI Fees to the IRS.

Our complete compliance strategy reviews and monitors minimum values, Affordability testing, Cadillac tax, trigger events, proper communications to employees, look back periods, exchange notices, enrollment notices with history, …… and the many more requirements you must do for the Affordable Care Act.

Reporting

Today entities that provide minimum essential coverage during a calendar year must provide specific information to the IRS. In audits, large employers are required to report to the IRS all full-time employees where they offer these full-time employees, and their dependents, the opportunity to enroll in “minimum essential coverage”.

ACA has two categories for Employer size

- Small employers which is 50 and below (FTE) full time equivalents.

- Large employers which is over 50 (FTE) full time equivalents.

Reporting Requirement - For 2017 Year to be filed in 2018